Full value from innovation can be realised by deploying technologies to scale in the UKCS. A greater technology uptake can then promote more investment in R&D by the UK Supply Chain, to deliver the next wave of technologies that are needed.

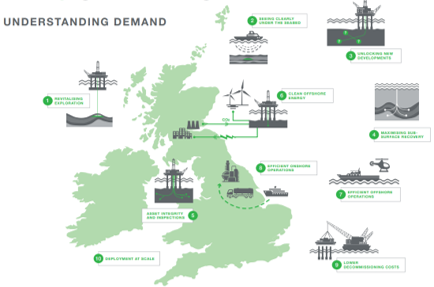

The TLB identified technology 10 grand challenges, ranging from exploration to decommissioning technologies, to support OGA Strategy objectives. Going forward, the offshore basin will also be critical for low-carbon energy solutions to deliver UK net zero targets, as per the Energy Integration Project findings published by the NSTA and other regulators.

It is very important that the industry (both Operators and Supply Chain) embrace common objectives in technology, to accelerate de-risking and deployment of existing solutions, and capture synergies in the R&D and piloting of new technologies.

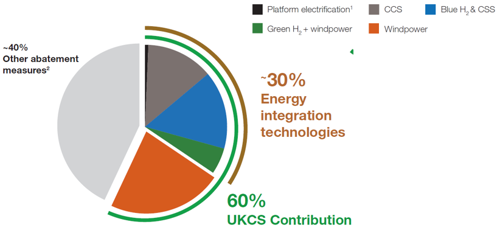

Based on the consolidated feedback from Operator's Technology Plans, and additional findings from the TLB and Energy Integration work, the NSTA has selected the following six priority technologies for industry’s consideration in the next period. These are critical technologies for applications for both ensuring economic recovery and the net zero transition.

The NSTA will engage Operators and Suppliers in 2021 to ensure progress in the six technology areas.

NSTA Priorities for Industry Focus

| Technology Priorities | Resource maturation | Net Zero |

|---|---|---|

| 1. Ocean bottom seismic | ✓ | ✓ |

| 2. Fibre and wireless surveillance | ✓ | ✓ |

| 3. Flaring and venting monitoring & abatement | ✓ | ✓ |

| 4. Non-intrusive integrity inspection & monitoring | ✓ | ✓ |

| 5. Alternative P&A barriers | ✓ | ✓ |

| 6. Subsea decommissioning | ✓ |

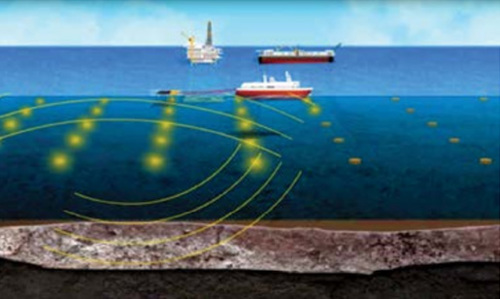

Ocean-bottom seismic

- Enhanced target illumination and 4D applications

- Growing track record on UKCS (>4 lead operators)

- Going forward - Critical for resource recovery and CCS monitoring

- High-perceived cost to be addressed through R&D

- Illuminates difficult targets (sub-salt and sub-basalt) though long offset with full azimuth

- Growing use in reducing uncertainty in development plans (Chevron, Total, BP)

- Used in 4D to improve data quality (access and repeatability) of surveys (Chrysaor)

- Established to acquire high-density, high-quality, full azimuth data sets

- Addresses issues with streamers acquisition (e.g. water column and seabed interference)

- Greater flexibility with survey design and logistics (eg. vessel operations, around existing infrastructure)

- Deployment systems developing to improve cost or functionality e.g. rope/wire deployed nodes, autonomous vehicles

- Technology fits well with current enhanced ability of companies to process and utilise broadband seismic

- Large scale OB surveys underway in Norway, GOM and Angola

Industry should focus on applications of existing technology:

- Acquisition for developments to resolve complex structures

- Use in operations to improve fluid identification in 4D

- OBN applications to work around other marine users e.g. wind farms, existing infrastructure

Further R&D take place:

- New generation nodes for improved deployment/recovery times (lower cost)

- Alternate signal source technology

- Processing algorithm and workflow development to extend use of broadband signal and data from new sources

- Enabling CCS monitoring (CO2 plume migration)

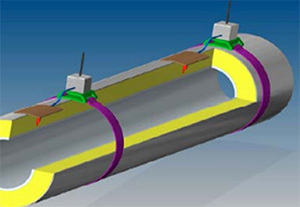

Fibre and wireless well surveillance

- Real-time observation of well performance and integrity monitoring

- Established technologies with broader application capability to be developed

- Both have retrofit capability to restore monitoring where existing sensors have failed

- R&D ongoing to improve service life (e.g. downhole battery life, fibre aging, data collection)

- Fibre optic distributed measurements from sand face to surface enable monitoring of a range of well management issues e.g. inflow, artificial lift performance, well integrity

- Observation of distributed well performance in real-time allows for faster response to well behaviour changes and improves production optimisation decisions

- Wireless systems can be installed as permanent monitoring during well construction avoiding need for wellhead penetration & cables

- Fibre and wireless can provide downhole data monitoring in wells with no or failed sensors

- Ability to return shut-in wells to service with wireless monitoring and control of retrofit equipment e.g. wireless DHSV

- Wireless technology can interface with smart downhole completion controls enhancing well functionality

- DTS capability is well understood and referenced by applications in multiple industries

- DAS potential for VSP and 4D seismic being explored using processing and AI

- Fibre can be run as multistrand cable, pumped down small bore conduit or run as stiff cable logging. New deployment systems allow single use fibre data aquisition

- A range of wireless technologies (acoustic, EMT, pressure pulse) are available and widely used e.g. LWD, DST

- Retrievable wireless systems can be deployed on wireline in platform and subsea wells

- Wireless monitoring of suspension and P&A barriers, Annulus pressure monitoring

- Retrofit wireless systems available for data acquisition and downhole equipment control

Industry should adopt existing technology:

- Consider the benefits from enhanced surveillance and application of “real-time” data to well management

- Screen available technology to return shut-in wells to production

- use data to monitor late life well optimisation and lift performance

- wireless devices to restore well functionality

Further R&D take place:

- Improve downhole battery life

- DAS applications for VSP, 4D seismic

- Enhance wireless monitoring in P&A

- Transfer oilfield applications to CCS

Flaring and venting monitoring

- Improve measurement accuracy of flare gas/liquid volumes

- Monitor flare combustion efficiency (potential release of liquid hydrocarbons)

- Vent gas measurement to aid quantification

- Identification and quantification of fugitive releases

- Process monitoring of flare efficiency to reduce hydrocarbon release from incomplete combustion

- Better monitoring could justify investment in vapour recovery systems

- Retrofit technology to upgrade monitoring of existing installations and reduce emissions

- Remote sensing technology (drones/satellite) to help operators to identify and confirm extent of releases

- Remote optical imaging AUV can help detect fugitive releases

- Video Imaging Spectral Radiometry using Infra Red detection to monitor combustion efficiency (BP)

- Vapour recovery is an established process technology (compression, educator)

- Retrofit metering established and demonstrated – range of techniques and vendors

- Over the Horizon drone surveys for CH4 detection approaching commercialisation (NZTC/operators)

- Optical imaging AUV allows inspection above deck level

Industry should screen existing technology for implementation:

- Retrofit monitoring to increase measurement points on existing installations

- Monitoring of “off” installation emissions

- Look to technology transfer from refining and petro-chemical industries

Further R&D take place:

- Continued adoption of technology for offshore use with focus on retrofit capability

- Improve monitoring for difficult to access areas

- Application of data analytics to improve quantification and monitoring

Non-intrusive integrity inspection

- Develop inspection technologies for vessel, pipeline and blind spot (including technology transfer from other industries)

- Further testing, confidence building - deployment to scale

- Significant safety, operational and cost benefits e.g. avoid vessel entry, working at height

- Reduce shut down frequency and duration, gaining production benefits and reducing environmental releases (e.g. reduced need for vent-purge-flush)

- Removes human inspectors from dangerous situations (confined space entry, working at height)

- Ability to complete inspections while plant is online reduces losses

- NII screening prior to shut-downs will help focus workscope on essential scope (detailed inspection, repair, replacement)

- Greater inspection time and efficiency than human inspectors can achieve

- Repeatable, quantifiable data generation

- Trial of robotic inspection of offshore process vessels while online has been demonstrated (Total/NZTC)

- Developments in deployment (robotics/crawlers) and navigation (laser scanning) will facilitate inspection out of line of sight and difficult access sites

- UAV technologies can be used for remote inspection of NUIs (control from onshore)

- Technologies already developed for other industry applications (e.g. petrochemical, wind turbines) provides opportunity for experience transfer

Industry should screen existing technology for implementation:

- Build experience using robotic and remote sensing for NII in vessel inspection, and CUI

- Engage with technology developers (e.g. supplier partnership, NZTC, JIP) to support concept maturity (TRL) and path to commercialisation

- Provide access to facilities for field trials

- Apply technology transfer from other industry sectors (e.g. offshore wind)

Further R&D take place:

- Additional sensing and deployment concepts for new applications

- Use of AI and ML for data analysis

- Incorporate design features of new offshore facilities to accommodate non-human inspection

Alternative P&A barriers

- Alternatives to cement for barrier construction to enable delivery of P&A programmes at lower cost with equivalent or better barrier performance (long term integrity assurance)

- Different barrier construction options required for different levels of abandonment complexity

- Rig-less deployment techniques that enable lower cost assets to be used more often

- Enabling technology to facilitate different approaches to P&A programme design and execution

- Alternative materials with different properties compared to cement

- Non-porous/very low permeability

- Inert or good corrosion resistance

- Ductility to accommodate geotechnical loads

- Maintain consistency during placement and setting

- Different approach to constructing well barrier elements

- Allow more intervention programme steps to be performed rig-less – cost saving potential

- Enables different approach to abandonment completion design and new approaches to P&A programme to be considered

- Potential deployment from less expensive vessels

- A number of potential solutions are at various stages of development and commercialisation

- Thermite plug

- Low melting point alloys

- Fluidised sand/clays

- Impermeable chemical precipitate

- Field trials onshore and offshore (UK) for P&A for some solutions

- Design allows for conventional cement barrier if unsuccessful

- Some technologies demonstrated in the field for non P&A applications but building deployment experience

- The NSTA has nominated Spirit Energy to be the Lead Operator in an industry/NZTC funded project to demonstrate deployment and verification of Alternative P&A Barriers

Industry should actively support development of alternate barrier solutions:

- Consistent verification methodology

- Support field trials e.g. funding, candidate wells, collaboration with supply chain

Further R&D take place:

- New materials

- Approach to qualification

- Verification and monitoring technology

- Deployment technology

- Application to CCS wells

Subsea decommissioning

- Recent technologies create a potential for ‘factory approach’ to subsea cutting & lifting, with potential cost reduction benefits

- Further upside by increasing use of robotic and AUVs

- Industry should accelerate field trials and technology adoptions

- Operators and Suppliers to work together and translate new methodologies into cost saving

- Subsea “factory” approach using repetitive processes provides cost saving opportunities

Application of multiple technology solutions as part of an integrated approach could deliver safer, more efficient, lower cost programmes - In situ decontamination/containment and verification technology would avoid the need to remove structures and facilitate reuse

- Enables the use of “fit for purpose” vessels to be utilised for various tasks (e.g. site preparation) at lower day rate

- ROV operated cutting technology available but time per cut can be slow

- Buoyant lifting technology is being developed that can speed up recovery

- Vertical Lay System vessel day rate costs remains a challenge for respooling and reuse or onshore cutting

- A range of diver and ROV operated systems exist for site preparation – cuttings pile removal, de-trenching, removal of coatings, marine growth removal

- Basic technology exists and is being developed, focus on efficient, safe, environmentally acceptable and reduced cost deployment is required

Industry should screen existing technology for implementation:

- Provide access to infrastructure for field trials

- Engage in collaborative projects with other operators and the supply chain to establish commercially viable subsea decom models

Further R&D take place:

- Increased use of ROV and AUV capability

- Explore reuse & accelerated in situ removal options (metal structure dissolution)

- Alternative cutting options (e.g. underwater laser, percussive charges)

Lifecycle Categories

Functional Categories

Disclaimer

The technologies referred to in this report are for illustrative purposes only and other technologies may be available. The NSTA does not directly or indirectly endorse, recommend or guarantee any entity, product or technology referred to in this report.