Overview

The tax regime which applies to exploration for, and production of, oil and gas in the UK and on the UK Continental Shelf (UKCS) currently comprises the following four elements:

- Ring Fence Corporation Tax (30%)

- Supplementary Charge (10%)

- Energy Profits Levy (35%)

- Petroleum Revenue Tax (0%)

Ring Fence Corporation Tax (RFCT)

This is generally calculated in the same way as the standard corporation tax applicable to all companies but with the addition of a “ring fence” and the availability of 100% first year allowances for virtually all capital expenditure (which is broadly equivalent to “full expensing” for non-oil and gas businesses). The ring fence prevents taxable profits from oil and gas extraction in the UK and UKCS being reduced by losses from other activities or by excessive interest payments. The current main rate of tax on ring fence profits, which is set separately from the rate of mainstream corporation tax, is 30%.

Supplementary Charge (SC)

This is an additional charge on a company’s ring fence profits (but with no deduction for finance costs). The current rate is 10%. The charge to supplementary charge may be reduced to zero on a slice of production income by the investment allowance (at a rate of 62.5% of investment expenditure), cluster area allowance (62.5% of investment expenditure) or onshore allowance (75% of capital expenditure).

Energy Profits Levy (EPL)

This is an additional, temporary charge on a company’s ring fence profits (but with no deduction for finance or decommissioning costs and with no allowance for losses generated prior to its introduction on 26 May 2022). The rate is 35% having previously been 25% until 31 December 2022. The charge to the EPL may be reduced by an investment allowance at a rate of 29% of investment expenditure (80% prior to 1 January 2023). There is an additional investment allowance for expenditure on upstream decarbonisation which means that investment in the decarbonisation of oil and gas production continues to benefit from the allowance at a rate of 80%.

The EPL is due to end on 31 March 2029 subject to an Energy Security Investment Mechanism (ESIM), which sets out circumstances in which the EPL would end early. The government will introduce legislation in Spring Finance Bill 2024 to provide for the ESIM. This will end the EPL early if the 6-month average price for both oil and gas is at or below the ESIM threshold prices.

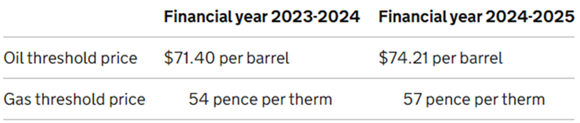

The original ESIM threshold prices were $71.40 per barrel for oil and 54 pence per therm for gas. These thresholds were based on a 20-year average to the end of 2022. These thresholds will be adjusted from 1 April 2024, and annually thereafter, by the preceding December’s year-on-year increase in the Consumer Prices Index. The original and uprated thresholds are as set out below.

Petroleum Revenue Tax (PRT)

This is a field-based tax charged on profits arising from oil and gas production from individual oil fields which were given development consent before 16 March 1993. The rate of PRT has been permanently set to 0% but it has not been abolished so losses (for example incurred as a result of decommissioning PRT-liable fields) can be carried back against past PRT payments which may result in a repayment of PRT previously paid. PRT was deductible as an expense in computing profits chargeable to RFCT and SC; refunds of PRT are chargeable to RFCT and SC and, to the extent that they do not relate to decommissioning losses, to the EPL.

Marginal tax rate

The current marginal tax rate on income from UK and UKCS oil and gas extraction is 75%. The current marginal rate of mainstream corporation tax is 25%.

Ring Fence Expenditure Supplement (RFES)

The RFES assists companies that do not yet have sufficient taxable income for ring fence corporation tax purposes against which fully to set their exploration, appraisal and development costs. The RFES currently increases the value of RFCT/SC losses carried forward from one accounting period to the next by a compound 10% a year for a maximum of 10 years, not necessarily consecutively.

Former elements of the regime

Brief details of former elements of the regime are given in the footnotes to the table of Historical Government Revenues from UK Oil and Gas Production at Government revenues from UK oil and gas production.

Further information on upstream taxation

This page provides a high-level overview of the UK’s upstream fiscal regime. More detailed information on the regime is available from HM Revenue & Customs.

The NSTA contact for further information is:

Mike Earp

Sanctuary Buildings

20 Great Smith Street

London

SW1P 3BT

Email: mike.earp@nstauthority.co.uk

Tel: 0300 067 1604 / 07785 692644