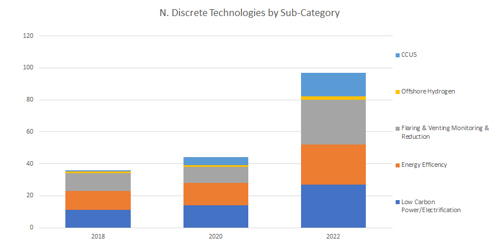

In 2022 survey data Operators report focus on technologies to reduce/replace the use of Gas Turbine offshore power generation: including hybrid power systems, topsides and subsea power packs for energy storage, alternative zero carbon fuel provision as well as Electrification from onshore, or offshore renewable energy sources.

Energy Efficiency is seen by operators as a cost effective way of reducing emissions and operating assets power generation and utilities more efficiently.

Evidence of large scale adoption of emission reduction technologies, increased diversity of monitoring techniques - both static and airborne methods to monitor emissions around and directly at source, operators seeking use software to monitor/ control combustion and venting processes more efficiently.

Several large scale green hydrogen hubs are being planned with targeted government funding already beginning to stimulate investment. CCUS is growing rapidly as a key carbon abatement methodology, multiple new projects at scale are emerging this year with a focus on CCS enabling technologies at all stages.

Summary Findings (CTRL-Click on Sub-Categories for detail)

- Low Carbon Power/Electrification

Net Zero technologies targeting Low Carbon Power/ Electrification are focussed on substituting/ reducing the dependency on fuelling Gas Turbine on-platform power: including Platform Electrification from Grid or from local Floating Offshore Wind, hybrid power systems, topsides and subsea power packs for short-term energy storage, and alternative low carbon fuels for turbines/ engines. - Energy Efficiency

Energy Efficiency technologies are gaining focus amongst Operators as a cost-effective way of reducing GHG emissions by reducing fuel consumption and boosting exported production over the remaining asset life. - Flaring Venting Monitoring & Reduction

Flaring & Venting monitoring and reduction technologies are an increased focus as Operators align with achieving zero routine flaring, open reporting aligned with the principles of OGMP 2.0 and anticipating methane’s inclusion in UK ETS proving strong combined drivers. - Hydrogen

Hydrogen is the sub-category most likely to expand rapidly over the next few years, early adopters are starting to introduce elements of this new fuel source, and several large scale green hydrogen hubs are being planned with targeted government funding already beginning to stimulate investment - CCUS

growing rapidly as a key carbon abatement methodology, multiple new projects at scale are emerging this year with a focus on CCS enabling technologies at all stages – transportation, well and tree design and subsurface assessments for reservoir containment and assessment of risk for storage in existing abandoned reservoirs

Growing interest in Net Zero technologies

- Over 50 technology plans submitted each year from 2018 to 2022

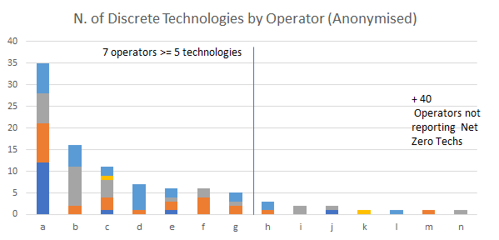

- Strong Increase in number of individual technologies reported, although reduction in the number of operators reporting interest in this area (Participation declining to 15 in 2022)

- Large number (40) of respondents not yet considering this theme (based on submissions)

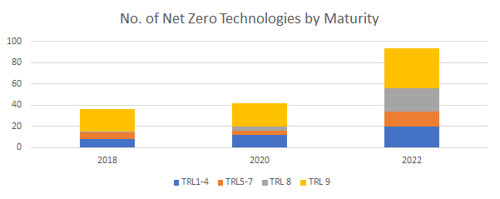

Net Zero technologies

- Operators are focusing on a smaller number of technologies ready for deployment (Early Commercialisation (TRL 8) and Existing or in widespread use Technologies (TRL 9)

- Growing pipeline of solutions remains healthy (TRL 1-7)

Net Zero maturity and deployments

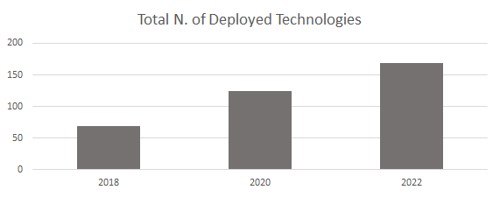

Once familiar with the technology the same operator deploys it at multiple assets (over 160 deployments reported/planned for 2021-23)

1. Low Carbon Power/Electrification

Net Zero technologies targeting Low Carbon Power/ Electrification are focussed on technologies to substitute/reduce the dependency on fuelling Gas Turbine offshore power: including Platform Electrification from Grid or from local Floating Offshore Wind, hybrid power systems, topsides and subsea power packs for short-term energy storage, and alternative low carbon fuels

- Subsea Power Bank - ECOG have developed a subsea power bank that could be used to support Mallard well power requirements either as a fast react solution or as a longer-term solution. The project team are assessing this in their Select Phase

- EnQuest (Mallard) TRL 9 Proven Technologies

- Low Carbon Power Solutions - Review wind power solutions & grid connection for the CNS as part of a collaborative effort with energy suppliers and other operators

- Apache (Forties) TRL 9 Proven Technologies

- Helix Wind turbine - Adding a wind turbine to a Hybrid Power System to reduce the running hour of the back-up diesel generator

- Shell (Barque) TRL 9 Proven Technologies

- Hybrid power system - Hybrid power system providing a maintenance free solution in the form of solar panels, providing power to the platform whilst charging batteries. Two small lean-burn diesel-engine driven generators will provide energy in case the renewable system fails.

- Shell ( Barque) TRL 9 Proven Technologies

- Battery storage - On-site battery system to generate value for the site as well as providing additional power resilience. Benefits: Reduced electricity bill, reduced maintenance cost, fuel gas saving, additional back-up power supply, GHG emission

- Shell (Barque) TRL 5-7 Late Development/Pilot

Technology Example :

Containerised Battery storage systems, reduce spinning reserve and provide a back up source of power

View Technology

- Alternative Fuel - Alternative low carbon fuel provision for site services. Pilot scale technology deployment of green hydrogen equipment at Easington Terminal being planned.

- Siemens Energy/ RWG TRL 5- 7 Late Development/ Pilot

- Centrica Storage (Rough) TRL 1-4 Early Development

- Subsea Power packs from QL Tech - local power supply from batteries subsea to power valves instead of intervention from DSV

- Harbour Energy (Britannia) TRL 1-4 Early Development

- Mocean/Verlume Wave energy converter subsea power system – generation of local power and storing in subsea battery packs, removing need for long umbilicals and additional power/ comms from platforms

- Harbour Energy/ Serica Energy TRL 5-7 Late Development/ Pilot

2. Energy Efficiency

Energy Efficiency sub-category is gaining in popularity amongst operators as a cost effective way of reducing emissions and operating assets power generation and utilities more efficiently.

- Peak load management - Emissions Reduction – Utilising load bank and battery technology to manage peak load and reduce need for higher diesel generation requirements

- EnQuest (Deveron) TRL 9 Proven Technologies

- Compression Rewheels - Use of latest technology to rewheel compression low lower plant pressures and increase plant efficiency with correctly sized compression

- Harbour Energy (Brittania *see full list in footnote below) TRL 9 Proven Technologies

- Optimised Power Management - Improve Power management system functionality, increase visibility through greater data handoff at high resolution for improved fault-finding and maximising efficiency

- Harbour Energy (Brittania) TRL 9 Proven Technologies

- Power sharing across assets - Installation of power sharing across assets through installation of subsea power umbilical. Reducing the requirement to run as much power generation reducing GHG emissions and operating costs

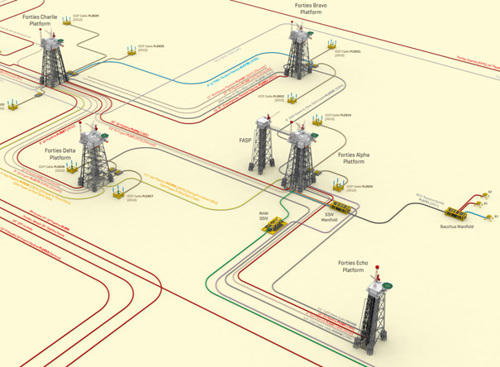

- Apache (Forties), CNR International (Brittania) TRL 9 Proven Technologies

Technology Example :

Apache Forties ring main – linking of platforms via subsea cables to share power generation and reduce number of gas turbines in the field

View Technology

- Energy efficiency optimisation - Implementation of Emissions.AI as part of the Dana emissions reduction programme. This tool will work in tandem with other OPEX group tools already in operation, and includes emissions associated with plant operation (Energy Efficiency) as well as those associated with operational flaring.

- Dana/KNOC (Barra/Clapham) TRL 8 Early commercialisation

- Electrifying Mech GT Drivers - Once power from shore / renewable is available the GTs could be converted to high speed electrical motors. Review available feasibly to change the GTs to e-motors to reduce CO2 emissions and increase PE and lower OPE.

- Harbour Energy (Brittania) TRL 8 Early Commercialisation

- Echogen - WHR Waste Heat Recovery to Power – Currently all the waste heat from the simple cycle GTs goes to the atmosphere that could potentially be used to generate electrical power. the challenge do this economically on a brownfield asset. Various options for Waste Heat Recovery to power are being assessed. Echogen is an offering from Siemens that may be a compact heat recovery engine to economically deploy offshore.

- Harbour Energy (Britannia) TRL 5-7 Late Development/Pilot

- Gas Compression Analytics - Use of data science methods to improve gas compression up time

- KNOC/Dana (Barra) TRL 5-7 Late Development/Pilot

3. Flaring & Venting, Monitoring and Reduction

Flaring & Venting, Monitoring and Reduction continues to show evidence of larger scale adoption of emission reduction technologies, increased diversity of monitoring techniques - both static and airborne methods to monitor emissions around and directly at source, operators seeking use software to control combustion and venting processes more efficiently

- Flare Gas Recovery - Flare Gas Recovery facilities/ Vapour Recovery systems– recovering & reprocessing gas to sales export

- 12 x Operators: *see* full list in footnote below, TRL 9 Proven Technologies

- Amine Vent Capture & Sequestration - Capturing the CO2 from the Amine Vent on the Elgin PUQ and injecting into nearby reservoir

- TotalEnergies (Elgin) TRL 9 Proven Technologies

Technology Example :

X-PAS™ is a digital solution for complex assets to predict threats, prevent system trips and reduce maintenance costs.

View Technology

- Optimise Offshore Plant Performance - Install X-PAS Emissions software on NCP and NSP. Monitor plant performance in association with OPEX and optimise running parameters to reduce GHG emissions

- CNR (Ninian) TRL 9 Proven Technologies

- LIDAR Attenuation Camera - Macro-Methane Emissions Quantification

- TotalEnergies (Glenlivet) TRL 8 Early Commercialisation

- Methane RPA Survey - unburnt hydrocarbons/methane site-level survey using remote piloted aircraft flown from onshore to offshore installations, improving safety, reducing risk, reduces OPEX

- 15 x Operators with FlyLogix/SeekOps TRL 8 Early Commercialisation

- Autonomous Methane Measurement - Measurement of methane emissions from unburnt fuel gas, unburnt flare gas, venting and fugitives. Use of ATEX rated autonomous measurement device to detect and quantify baseline methane emissions and abnormal events using TDLAS measurement technique.

- Harbour Energy (Brittania) TRL 5-7 Late Development/Pilot

- Flare Combustion Efficiency – asset/site-level assessment of flare system combustion efficiency to determine reportable methane slip

- 5 x Operators with Accord/ NEL Late Development/ Pilot

4. Hydrogen

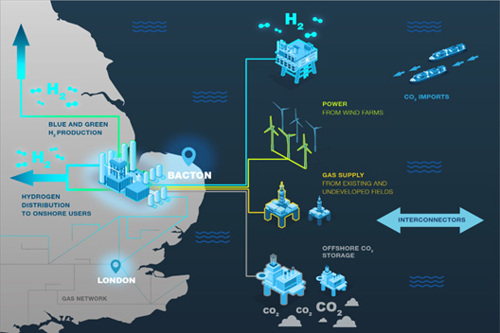

Hydrogen is the sub-category most likely to expand rapidly over the next few years, early adopters are starting to introduce elements of this new fuel source, and several large scale green hydrogen hubs are being planned with targeted government funding already beginning to stimulate investment

- Offshore Hydrogen - Repurposing Assets for offshore hydrogen production

- CNR (Ninian, Tiffany) TRL 1-4 Early Development

- Fuel switching - Alternative zero carbon fuel provision for site services. Pilot scale technology deployment of green hydrogen equipment at Easington Terminal being planned.

- Centrica (Rough) TRL 1-4 Early Development

Technology Examples: Multiple Hydrogen production hubs and projects are being developed and prepared for future Hydrogen production at scale:

- ACORN, Bacton Hub, Cromarty Hydrogen Project, DolPhyn

- Flotta Hydrogen Hub, HyGreen – Teeside, GiGaStack, Sullom Voe

Technology Example :

Five special Interest groups (SIG’s) focussing on specific elements of Hydrogen Production

Technology Example :

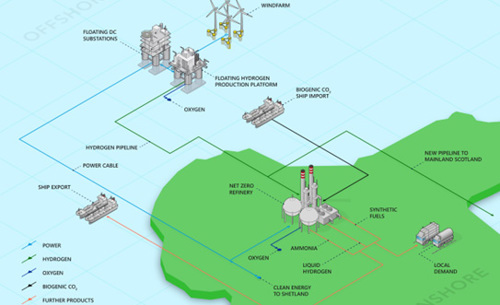

Sullom Voe – H2 and Low Carbon Fuels Application to INTOG leasing round (Aker Offshore Wind) H2 generated at Sullom Voe Terminal (Enquest)

Technology Example :

Hub - Green hydrogen production and export facility in Orkney Awarded floating wind option west of Orkney in Scotwind offshore wind leasing round -- H2 Critical to fully monetise windpower capacity Hydrogen transported to UK mainland via pipelines (also repurposed)

5. CCUS

Carbon Capture Utilisation & Storage (CCUS) is growing rapidly as a key carbon abatement methodology, multiple new projects at scale are emerging this year with a focus on CCS enabling technologies at all stages – transportation, well and tree design and subsurface assessments for reservoir containment and assessment of risk for storage in existing abandoned reservoirs

- CO2 Injection Well Design - Cement Sheath Modelling - Initial flow assurance results have indicated cryogenic injection conditions for the majority of the wells design life. Among the challenges associated with this is the impact of the cold temperatures on the effectiveness of the annular cement sheath over the life of the well and for abandonment in perpetuity.

- Harbour Energy (Victor) TRL 9 Proven Technologies

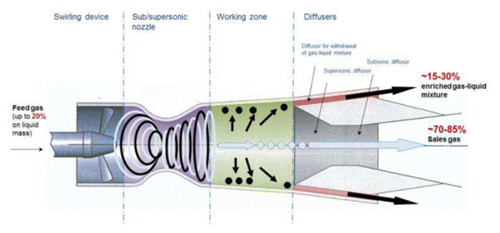

Technology Example :

Supersonic Separators (SSS) Already used by a number of Operators in Russia and China, Malaysia (Shell) for dewatering and heavy hydrocarbon removal applications. Early trials in Lab conditions for CO2 removal for Petrobras/FMC/Engo - Separation of methane/CO2 achieved.

View Technology

- In-line inspection for offshore pipeline repurposing - The LOGGS offshore pipeline will be repurposed for CO2 transportation. Fracture and corrosion assessment has been completed but an in-line inspection using intelligent pigs will confirm assumptions and results from this assessment. Planning and execution of an in-line inspection to repurpose existing oil and gas infrastructure for CO2 transportation.

- Harbour Energy (Victor) TRL 5-7 Late Development/Pilot

- Qualification testing for well elastomers - Existing elastomers are not qualified for anticipated low temperatures or the envisaged CO2 specification and impurities from emitters. Qualification testing will allow for suitable material selection. Lab testing to qualify various elastomers for new CO2 injection wells.

- Harbour Energy (Viking C) TRL 5-7 Late Development/Pilot

- Subsurface CO2 Storage Assessment - Subsurface modelling with potential for new data acquisition and processing to allow modelling of CO2 injectivity, migration within the reservoir and containment of the CO2 subsurface. Understand the risk from CO2 storage in depleted reservoirs and the critically the assurance of the containment within the reservoir and include the assessment and impact of P&A wells in the existing reservoir.

- Harbour Energy (Viking A) TRL 1-3 Early Development

- Carbon capture utilisation and storage - CCUS applications for reducing GHG emissions and improving reservoir recovery through EOR. Potential to utilise Tiffany as a hub

- CNR International (Ninian) TRL 1-3 Early Development